Savings: What to Do and What Not to Do During a Time of Uncertainty

We understand that it is an unprecedented and unstable time right now. With so much uncertainty in the air, it’s only natural to start worrying or becoming anxious, particularly when it comes to your finances. We’ve all been there. Take a deep breath and let us help you navigate through what you should be focusing on during this time. As your financial partner, we promise to be here during each step and to guide you calmly. We are a cooperative and now more than ever, we are all in this together.

Time to Use Your Emergency Fund

This is what your emergency fund has been waiting for! This is the true definition of emergency and it has never been more of an appropriate time to use it. Many Americans may have the tendency to rely on credit cards instead of using money they already have in their account. It can be scary to continually see your savings account balance lower, but it is incredibly better for you to use cash on hand rather than relying on credit and debt. The obvious reason is you don’t want to build up large interest charges, but also if you get in a bind and temporarily lose your job, having one less bill can make a remarkable difference for your stress level.

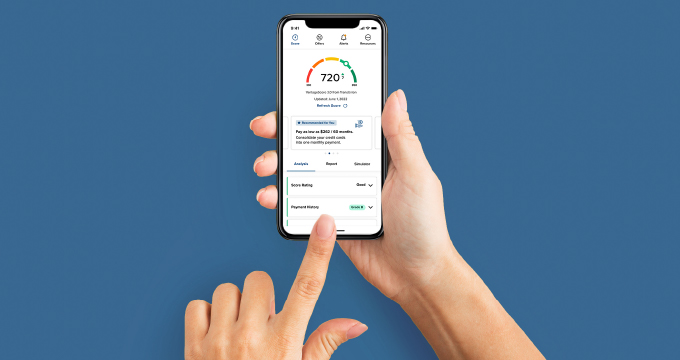

If you get in a situation and have to default on that credit card, you can tank a perfect credit score. Cash is always best to use in this situation! However, do not pull out all of your savings from the bank. Social distancing and self-isolation may take a longer time than we think. We’ll be using credit and debit cards more than ever. The internet will still work and we will continue to make purchases on the web. In fact, you probably will be using less cash than you have prior to this event. Keep your money in the credit union so you can continue to earn interest and make those online purchases.

No cash on hand? Sometimes if we don’t have a rainy day fund, we don’t have any other choice but to take out a loan to pay for bills. In this situation, always contact your friendly local credit union because their rates will more than likely beat other institutions, including Meritus Credit Union’s which is as low as 7.9%.

Don’t Touch Your 401k

We know, it’s tempting right now to login or open your statements for your 401k. We advise you not to. Why? It may make you panic a little bit to see your balance much lower than the last time you looked. But worry not—this is expected and natural. It wasn’t too long ago that we were in the recession of 2008 and many retirement accounts took a nosedive. Think of your 401k as a rollercoaster: the economy will have twist and turns, high and low points.

The only thing you have to worry about is not getting off at the high! Or else you’ll be taking your money at a loss. Instead, if you have patience and can stand in the chaos, you are statistically more likely to have higher returns over the course of your whole investment. Any investment professional can tell you that not only do they expect this to happen, depending on your age before you retire, this will happen again. Stay the course, and you will still be able to win with your retirement account.

Check on Your Student Loans

First and foremost, the following rules do not apply if you financed with private student loans. You will need to check with your loan provider to know if they are offering any relief. If you instead took out (public) federal student loans, you have a couple of options. Those who are still employed and receiving a paycheck will continue making minimium monthly payments. One change is the whole loan payment will be going to your principle loan amount. The good news is this can help you pay your loans off faster in the long run since you are not paying interest. But at this time, still budget for what your minium payment has been in the past. If you have been laid off due to COVID-19, you can apply for a loan deferment, up to 60 days, as of today, March 23rd. Contact your loan provider to file the deferment.

Pause Paying Off Extra Debt

If you are trying to lower your debt or participating in Dave Ramsey’s Debt Snowball – now is the time to hit pause. Even if you still have a job and paycheck coming to you each month, the unsteadiness of the economy is uncertain and it may be possible you will need an extra cushion in your emergency fund to weather these times. The good news is once this emergency time is over, if you have an overflow of funds that you didn’t need to use, you can just apply it all back to your debt. This will help you get on track and closer to being debt-free.

We are here for you during this difficult time. Call us at 337.989.2800 if you have any questions about your accounts or on anything else we can assist with.

Sources:

Trump to waive interest on federal student loans 'until further notice'